Real Estate Activity Picks up in June but Home Sales Take a Hit: Report

With most states announcing relaxations in travel movements amid a dip in the number of daily new infections, the month of June has seen a pick-up in demand in real estate, shows a report by PropTiger.

According to the report, titled Real Insight (Residential) – April-June (Q2) 2021, half of the sales in the April-June quarter of 2021 took place in June itself as states started to open up and remove restrictions.

While demand and supply both remained adversely impacted during the first two months of the quarter, a period when most states remained in partial lockdowns to contain the virus spread, home sales and new launch numbers started to pick up in June, with the gradual lifting of restrictions.

“Due to the challenging situation during the April-June quarter in 2021, when infections and casualties caused by the coronavirus hit a peak before subsiding towards the end of May, both demand and supply were hit during the first two months when most states put in place various restrictions and lockdowns to curb the spread of the virus. However, some ground on both the numbers was covered during the month of June, when states started to open up. The same is reflected in Q2 demand and supply numbers. We expect improvement on both these indicators of residential real estate health in the upcoming quarters since India’s vaccination programme is likely to gather pace,” said Dhruv Agarwala, Group CEO, Housing, Makaan & PropTiger.

“It’s also important to mention that despite the lockdowns and subdued sentiment, the government gave the sector a much-needed boost with the passing of the Model Tenancy Act which is expected to give a fillip to the much-needed rental housing supply in the country. The RBI is also doing its bit by continuing to maintain its accommodative stance, keeping the repo rate and reverse repo rate at a status quo of 4% and 3.35%, respectively, which in turn would allow the low mortgage interest rate regime for homebuyers to continue. All these measures, combined with latent demand, will certainly help our sector to bounce back faster than what was anticipated earlier,” he added.

“While the impact of the second wave of the virus was universal, some markets were impacted more as they were the hardest hit by the second wave of the pandemic. This has been reflected in the high levels of unsold inventory and higher inventory overhang in markets like the NCR and MMR. This is especially true of the NCR market, where the inventory overhang is as high as the MMR even though the unsold stock in that market is less than half of what is there in the MMR,” said Mani Rangarajan, Group Chief Operating Officer, Housing, Makaan & PropTiger.

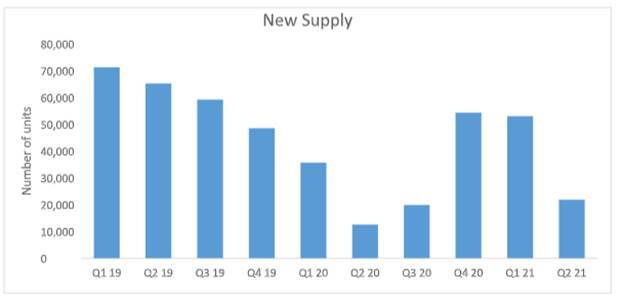

New supply remains resilient amid second wave; shows 74% surge YoY in Q2 2021

The economic uncertainty caused by the second wave of the coronavirus pandemic has forced real estate developers in India to adopt a more cautious approach towards spending, which is reflected in new supply numbers for the April-June period (Q2) of CY 2021.

In the three-month period that saw dramatically high numbers of infections and fatalities caused by the virus spread, supply of new apartments in India’s eight prime residential markets witnessed a decline of 59% when compared to the January-March period of this year, the report shows. A total of 21,839 new units were launched in these markets during Q2CY21. However, when compared to the same period last year, new launches show an increase of 74%.

This remarkable increase in the launches in Q2 over the same period the previous year could be explained by the fact that during a large period of Q2CY2020, India continued to remain under a national lockdown that adversely hit the economy, forcing Asia’s third-largest economy to slip into recession in 2020. This forced liquidity-starved real estate builders in the country to tread highly cautiously during April-June 2020.

Affordably priced housing continues to be the key focus area for India’s real estate developers, and this is evident from the fact that a majority of the new supply was concentrated in the mid-segment. In fact, 35% of the projects launched in Q2 were in the Rs 45-75 lakh price bracket.

Affordably priced housing continues to be the key focus area for India’s real estate developers, and this is evident from the fact that a majority of the new supply was concentrated in the mid-segment. In fact, 35% of the projects launched in Q2 were in the Rs 45-75 lakh price bracket.

Home sales decline 16% YoY

Even though real estate has emerged as a popular asset class among consumers in the aftermath of the pandemic, housing sales in Q2 showed a decline on a sequential as well as year-on-year basis. With 15,968 transactions being recorded across these eight markets during the second quarter, home sales during the three-month period ending June 30 declined 16% YoY while registering a 76% QoQ fall. All cities saw sales declining quarter on quarter while annual comparisons show some improvement for a few cities.

With the second wave of the pandemic posing questions about the certainty of incomes, home buyers put on hold their plans to invest in property despite the fact that a 15-year-low home loan interest rate currently makes property purchase a sound financial proposition. According to the report, 45% of homes sold during the three-month period were priced up to Rs 45 lakh.

Commenting on the findings of the report, Pradeep Aggarwal, Founder & Chairman – Signature Global Group, & Chairman – ASSOCHAM National Council on Real Estate, Housing and Urban Development, said, “Sales have continued to climb due to record-low house loan interest rates, subdued residential pricing, and buyer-friendly payment choices, demonstrating that demand and customer confidence have returned to the market. A majority of transactions are completed by first-time homebuyers, which is a positive trend because they account for most sales. This quarter, affordable housing came out with flying colours, with 57% of the overall sales concentrated in the less than Rs 45-lakh price bracket.”

Developers say that even though the second wave of the pandemic was devastating, the demand for greener, safer, larger, and low-density living has spurred home purchases.

Nayan Raheja, Executive Director, Raheja Developers, said, “Real estate had recovered substantially after the initial wave. Compared to the same period last year, it demonstrated good sales and quick closings in residential transactions. Pre-rented commercial real estate investments have also performed nicely. Even though the second wave was devastating, the demand for greener, safer, larger, and low-density living spurred home purchases. All real estate segments, including luxury, mid segment and commercial properties, are experiencing strong demand. Demand for nicer, safer, and larger homes is at an all-time high in low-density areas with particular buoyancy in 4/5BHKs, farmhouses, and villas.”

“The reports coming in suggest that the second wave has only strengthened people’s resolve to seek out real estate assets. People are particular about the size of units and the health amenities provided in residential projects. They are looking for long-term financial security in real estate, which has increased first-time homebuyer queries,” said Yash Miglani, MD, Migsun Group.

Harvinder Singh Sikka, MD, Sikka Group, said, “The pandemic, combined with buyers searching for a good deal, drives them to real estate assets. Many developers are offering freebies, which are even more appealing given the low-interest rates on home loans. First-time homebuyers are aware of the impending price rise scenario — reports point out that the NCR saw a 2% increase in prices — prompting them to purchase a home as soon as possible.”

Affordably priced housing continues to be the key focus area for India’s real estate developers, and this is evident from the fact that a majority of the new supply was concentrated in the mid-segment. In fact, 35% of the projects launched in Q2 were in the Rs 45-75 lakh price bracket.

Home sales decline 16% YoY

Even though real estate has emerged as a popular asset class among consumers in the aftermath of the pandemic, housing sales in Q2 showed a decline on a sequential as well as year-on-year basis. With 15,968 transactions being recorded across these eight markets during the second quarter, home sales during the three-month period ending June 30 declined 16% YoY while registering a 76% QoQ fall. All cities saw sales declining quarter on quarter while annual comparisons show some improvement for a few cities.

With the second wave of the pandemic posing questions about the certainty of incomes, home buyers put on hold their plans to invest in property despite the fact that a 15-year-low home loan interest rate currently makes property purchase a sound financial proposition. According to the report, 45% of homes sold during the three-month period were priced up to Rs 45 lakh.

Commenting on the findings of the report, Pradeep Aggarwal, Founder & Chairman – Signature Global Group, & Chairman – ASSOCHAM National Council on Real Estate, Housing and Urban Development, said, “Sales have continued to climb due to record-low house loan interest rates, subdued residential pricing, and buyer-friendly payment choices, demonstrating that demand and customer confidence have returned to the market. A majority of transactions are completed by first-time homebuyers, which is a positive trend because they account for most sales. This quarter, affordable housing came out with flying colours, with 57% of the overall sales concentrated in the less than Rs 45-lakh price bracket.”

Developers say that even though the second wave of the pandemic was devastating, the demand for greener, safer, larger, and low-density living has spurred home purchases.

Nayan Raheja, Executive Director, Raheja Developers, said, “Real estate had recovered substantially after the initial wave. Compared to the same period last year, it demonstrated good sales and quick closings in residential transactions. Pre-rented commercial real estate investments have also performed nicely. Even though the second wave was devastating, the demand for greener, safer, larger, and low-density living spurred home purchases. All real estate segments, including luxury, mid segment and commercial properties, are experiencing strong demand. Demand for nicer, safer, and larger homes is at an all-time high in low-density areas with particular buoyancy in 4/5BHKs, farmhouses, and villas.”

“The reports coming in suggest that the second wave has only strengthened people’s resolve to seek out real estate assets. People are particular about the size of units and the health amenities provided in residential projects. They are looking for long-term financial security in real estate, which has increased first-time homebuyer queries,” said Yash Miglani, MD, Migsun Group.

Harvinder Singh Sikka, MD, Sikka Group, said, “The pandemic, combined with buyers searching for a good deal, drives them to real estate assets. Many developers are offering freebies, which are even more appealing given the low-interest rates on home loans. First-time homebuyers are aware of the impending price rise scenario — reports point out that the NCR saw a 2% increase in prices — prompting them to purchase a home as soon as possible.”